We ‘drill down’ and ‘sideways’ as StratDem looks more closely at the geopolitical, strategic and market forces at work in the oil patch. The House of Saud, in particular, has taken OPEC in a new direction — and consequences are worldwide and considerable…

Update: Petrol politics with impact…

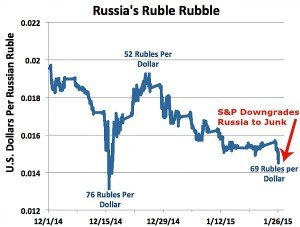

January 27, 2015 — Russian economy and Ruble/Rouble continue to drop

○ ○ ○ ○

Oil prices in the US

Halliburton’s CEO public predictions for oil price/production

○ ○ ○ ○

Let’s begin our end of the year review with Foreign Policy looking at the consequences — and motivation — behind the Saudi actions to depress prices and, as an effect, put pressure on its enemies.

Who’s on its “enemies” list? Iran and Russia (with links to Syria/Iraq), and the rising production of “fracking”, sideways-hydraulic drilling technology, which is spreading from the US to worldwide oil fields.

The Iran conflict is Shia v Sunni/Wahhabism and as it is a struggle of some 1500 years, with the current antagonism being the latest chapter in a millenial religious war, we can expect nothing less than ongoing antagonism fueled by oil revenues. The House of Saud can handle temporarily diminished oil revenue due to its reserves and non-sanctioned economy. The Iranian authorities, it is assessed, with limited reserves, damaged economy due to sanctions, cannot handle substantially reduced oil revenue in the mid- or long-term. The Saudi’s OPEC decision reflects a tactical move against a sanctioned, ‘injured’ Iran in the struggle for regional influence. This is the message being communicated — a Saudi strategic/tactical move against its #1 enemy at a moment when its historic and present-day foe is damaged and wavering, as a US led international sanction regime against Iran’s nuclear energy program presses and, if current nuclear negotiations fail, a regional war looms in the foreground.

The second ‘enemy’ of the House of Saud is the Russian Federation. Russia’s oil production is in competition with Saudi Arabia and Russian support for Syria in opposition to Saudi support for anti-Assad forces ranging from secular to ISIS (now in flux) has crossed over into economic conflict. The move to use oil production/pricing against an oil-revenue-reliant Russian economy could have a US connection, part of a larger geo-political chessboard, though this is a strategy fraught with peril if, in fact, it is being played out.

Saudi concerns and, in effect, a preemptive price war move against the US fracking industry, which has quickly risen with its technology to threaten Saudi markets internationally, is another impact of the House of Saud’s petrol politics… the Saudi move here, given their dominant market position, is shades of an old tactic, predatory pricing and perhaps one reason the President of Russia is predicting oil prices will go back up once this skirmish, as he sees it, finishes its run.

Is Putin’s prediction of oil prices stabilizing and ‘balancing’ in 2015 a bet to place – as he has gone on record attempting to predict when oil/gas prices will rebound… Or is the timeline of US fracking production a longer production timeline, designed to outlast slumping oil patch prices? Are larger strategies playing out? Is a policy of sanctions plus depressed oil prices and oil revenues for Russia and Iran playing out? Is there a Saudi play against incursions of alt energy across the world, are cuts in oil prices meant to slow alternative energy sources replacing Saudi supplied energy? Is there a squeeze on the Saudis to dampen prices to boost the US economy — a calling in of debts for past US provided ‘services’ to Saudi Arabia? Are the Saudis, of their own volition, going after Russia and Iran, their ‘neighborhood’ enemies, and not the US fracking industry as Foreign Policy ventures here?

-=-=-=-=-=-=-=-=-=-=-

Some in the Russian oil field are publicly charging that the Organization of Petroleum Exporting Countries is keeping prices at artificially low prices in order to wipe out the burgeoning shale industry in the United States. Leonid Fedun, vice president of strategic development at Russia’s OAO Lukoil, predicts that with oil at $70 a barrel, American companies will decide, as time goes by, that the cost of exploration isn’t worth the return. When that happens, Mr. Fedun predicts OPEC will jack up the price again… Is Mr. Fedun’s analysis accurate, are the Saudis looking to damage their long-time strategic partner, the US — or, more plausibly, are deeper currents moving strategy?

-=-=-=-=-=-=-=-=-=-=-

Let’s take a look back at some of StratDem’s recent pronouncements re: oil as a weapon:

Dec 22 – Russia Squeezed, Oil Producers Squeezed

The end of the calendar year traditionally calls for reflection about the past and hope for the future. This year we pause to consider a number of concerns and ‘keywords’ to keep front of mind…

Economic warfare, geopolitical shots across the bow or not?

Oil decisions not linked to politics

No links to politics Saudis say

Saudi confrontation with Russia

ξ

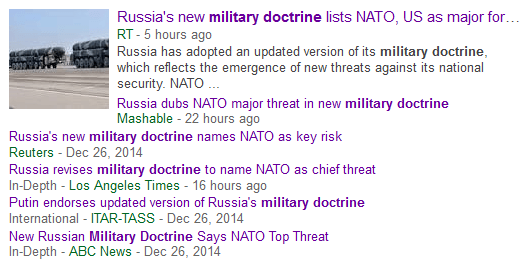

The question, of course, the Russians ask is to what extent is the Saudi strategy a strategy coordinated against Russia… to what extent is the West, the US, NATO, EU coordinating a strategy of oil/gas against Russian oil/gas and national interests?

In the geo-political realm, as can be expected, push-back follows… saber-rattling.

-=-=-=-=-=-=-=-=-=-=-

Dec 12 – Stranded Assets? Full-cost assessment?

While the politics, political economy, strategic policy of oil/gas conflicts play out — across the world the alternatives in energy conduct business in Lima, Peru

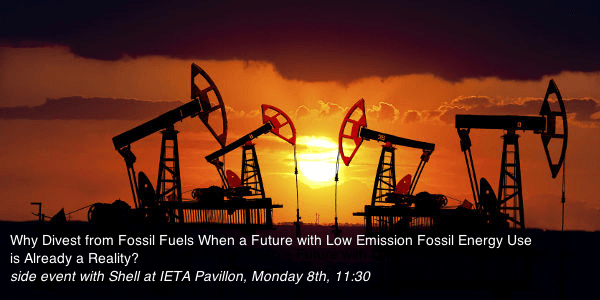

As we arrive at the Lima conference we look at how Shell positions itself at an environmental gathering of nearly every nation of the world.

Shell, a gamut of oil/gas companies and varied elements within the energy industry raise a trading flag at the IETA, while prominent oil/gas association members lobby against fossil fuel divestment campaigns. As Shell repositions from full-out opposition to ‘willing to negotiate’, one sees the time has come for pricing carbon as part of an environmental full-cost movement.

The ‘true costs’ of oil/gas have the potential to cause environmental catastrophe. Green assessment of external costs need to be addressed now, sooner rather than later, and even the industry is beginning to take notice in the form of shifting negotiating, and public policy, positions.

With the drop in fossil fuel prices comes challenge and opportunity — the IEA sees a unique opportunity.

○

With the drop in oil prices “delivering a shot of economic stimulus to consumers around the world”, policymakers have a “once-in-a-generation” chance to take actions to cut our reliance on fossil fuels, writes Maria van der Hoeven, Executive Director of the International Energy Agency (IEA). She urges policymakers in developed countries to use the drop in oil prices to put a price on carbon.

https://twitter.com/VanderHoeven_M

○

Shell’s pitch…

-=-=-=-=-=-=-=-=-=-=-

Nov 30 – Economic War?

Oil/Gas Skirmishing

The vision of petro-dollars join into political strategy as OPEC and producer decisions to take oil into decision-making — and politics “by other means”, economic pressure and war-making in effect.

The latest mix of security and market forces brings another level of risk going forward.

Experts on matters petro are failing to predict how the players will act, as both strategic and market imperatives operate and, sub rosa, politics plays out…

This week was revealing as OPEC chose to keep production as is, hoping to maintain market share, while other forces percolated behind the scenes, e.g., diplomatic initiatives and strategic demands, the level of demands that involves pressure on states (Russia) who are relying on petro-revenues and, in the event the revenues fall due to falling prices, their positions globally, militarily, economically are damaged, potentially profoundly and consequentially.

Scan some of the latest information about the petro-skirmishing — the layers of decision-making are deep.

Oil prices plunging, Russia buckles

◊

Financial Times, December 1, 2014

as the market opens …

Oil rout resumes, prices lowest since 2009

The end of an oil era?

The bottom has dropped out of the oil market, with both main pricing benchmarks shedding over $2 to trade at their lowest levels in five years.

The price of a barrel of Brent oil fell as much as 3.7 per cent to a low of $67.53 today, while the West Texas Intermediate dived to a low of $63.72, also down as much as 3.7 per cent. At pixeltime the benchmarks were trading at $67.92 and $64.05 respectively.

That is the lowest since mid-2009.

Rouble falls by most since 1998 Russian crisis

The Russian rouble has smashed past the 50 per US dollar mark for the first time in history, as sliding oil prices ramp up pressure on the Russian currency.

The rouble is comfortably the worst performing major currency in the world this year, and extended its 2014 dive against the dollar to 36.4 per cent today by slumping another 4.5 per cent to trade at 51.668 in early London trading.

That decline is the worst since the Russian financial crisis of 1998.

The Russian currency has been hurt by ongoing capital outflows, exacerbated by a series of westerns sanctions slapped on Moscow over its annexation of Ukraine’s Crimea region and support for separatists in eastern Ukraine, but more recently the oil price tumble has taken the heaviest toll.

The economy is heavily dependent on oil, whose price nosedived last week after Opec decided against cutting oil production to buttress prices. That has sent both the WTI and Brent price benchmarks to four-year lows, and hammered the currencies of oil-exporting countries like Nigeria and Russia.

Petro conflict continues to heat up as political pressure is brought to bear and the Russian bear takes hits …

Costs to Russia about $140 billion —7% of GDP — in the last year, says finance minister

The falling oil price is costing Russia up to $100bn a year, while Western sanctions have hit the country by $40bn, its finance minister has said.

Anton Siluanov made the comments on Monday at an international financial and economic forum in Moscow.

◊

While the worlds of oil/gas are enmeshed in turmoil and conflict, in the larger picture the threat to global climate continues unabated.

-=-=-=-=-=-=-=-=-=-=-

Oct 30 – Conflict with Russia escalates

House of Saud and OPEC oil strategy plays out

Goldman Sachs forecast roils the energy market

◊

Vladimir Putin speech to the Valdai International meeting’s on “The World Order: New Rules or a Game without Rules” shakes up Europe and the U.S.

New Cold War rhetoric continues – “Putin accuses the U.S. of undermining the post-Cold War world order”

-=-=-=-=-=-=-=-=-=-=-

Oct 25 – Oil as a weapon against Russia

Geo-politics/Oil politics

The question is: What is the Saudi motivation for wholesaling its oil?

Reuters reports Saudi officials have been privately admitting to oil market participants that they are ‘comfortable with lower oil prices’. According to the news service, the Organization of the Petroleum Exporting Countries (OPEC) is willing to accept prices as low as $80 a barrel for as much as the next two years.

The problem is that Russia’s latest budget requires oil prices to average at least $100 a barrel in order to cover the government’s spending promises.

As of Oct 24, the price of crude future contracts is 89.23 per barrel and falling…

Putin has backstopped Russia’s oil income with its recent historic LNG/natural gas China deal, but at what cost? The Chinese played hardball in negotiations, walking away at the 11th hour, forcing Putin back to the table given the situation in Europe and Ukraine and falling market prices in the international market.

The longer term message to Russia and all petro-producing states is that oil/fossil fuel/petrodollars are non-renewable resources and while fracking techniques and aggressive exploration can put off the days of reckoning, the days of reckoning are coming. When the Petrodollars run out (Foreign Policy w/ charts)

-=-=-=-=-=-=-=-=-=-=-

Oct 16 – Oil pricing as a weapon against alternative energy development

· U.S. military operations represent the largest consumer of all forms of energy globally…

· U.S. troops in Afghanistan pay the equivalent of $400 per gallon of fossil fuel when security, transportation and mortality costs are tallied up…

– Wesley Clark

former NATO supreme allied commander arguing for more renewable sources of energy

Clark: “As the U.S. went from oil-exporting to an oil-importing nation, we shipped trillions of dollars abroad, undercutting our own economy, funding adversaries and fighting three wars directly or indirectly about oil.”

“Energy IS national security, as the U.S. has learned at great expense.”

“In coming decades, the world will be able to move away from petroleum and toward electric transportation, relying primarily on renewable sources, like solar and wind, distributed generation, and new storage technologies. Not only because they make economic sense, but also for the sake of our own national security. As Americans, we want to be there, in the lead.”

The US Defense Dept/Pentagon and Energy security

https://strategicdemands.com/stratdem-factoid-re-road-security/

-=-=-=-=-=-=-=-=-=-=-